Information pack

for auditors

What should every auditor know about Business Finland funding?

The funding granted by Business Finland is governed by several laws and regulations. These laws and regulations, as well as the goals and scope of each funding service influence the requirements placed on auditing in each case.

In recent years, new funding services have been developed to meet the changing funding needs of clients, each with their specific terms and conditions for funding. Due to the diversification of the services, it is essential that the correct report template is used.

The funding terms and conditions and their related auditor's report templates are updated whenever a need arises. The report templates have been prepared in cooperation with the Finnish Association of Auditors with input from both parties. The latest version of the auditor's report is always listed on this page. It should be used as the report template, regardless of the time of issuing the funding decision.

Auditor's services can be helpful already during the project's implementation

We recommend our clients that upon receiving the funding decision, they share its content and terms and conditions with the auditor in their company who will perform the financial audit for the project’s final report. In this way, the auditor is informed of the upcoming audit well in advance, and is able to instruct the beneficiary of funding in complying with their project monitoring obligations.

Costs declared in interim reports are approved preliminarily and may be corrected by both the client and Business Finland within the duration of the project. Final approval of the costs can only be given after the final report and auditor’s report for the project has been received. The auditor’s report is of crucial importance in the approval of project costs and the payment of funding.

Receiving access rights to project information in the online service

The Business Finland online service provides a concise overview of the correspondence of project documents between the beneficiary and Business Finland. Documents readable in the service include decisions on funding and changes and payment orders in chronological order, as well as reports and cost statements and their appendices. The exception to this is the salary specification, which is restricted from viewing due to the confidentiality of salary information. As a result, the salary specifications (Y4) included in cost statements must be requested separately from the beneficiary.

Reported costs can also be viewed in the online service. The costs and payments page displays costs that have been preliminarily approved for each reporting period of the project by Business Finland. As cost statements that have already been delivered cannot be corrected in the online service, correspondence regarding possible corrections is not displayed. Check with your client to verify that you have received all cost statements as delivered for each reporting period, including possible corrections.

Since the start of 2018, changes to the project have been displayed in the online service, and the service stores both the decisions on changes, as well as the applications and their reasons.

If you do not have access rights to the online service, request the documents necessary for the audit from the client.

Auditing of project costs

Review the funding decision and its terms and conditions, and select the correct auditor's report template. Be sure to also check for possible special terms and conditions included in the funding decision.

The report template explains the audit procedures and their scope. Be sure to answer all questions in the auditor’s report in order to provide Business Finland with sufficient information to process the cost statement and pay the funding.

Audit sampling

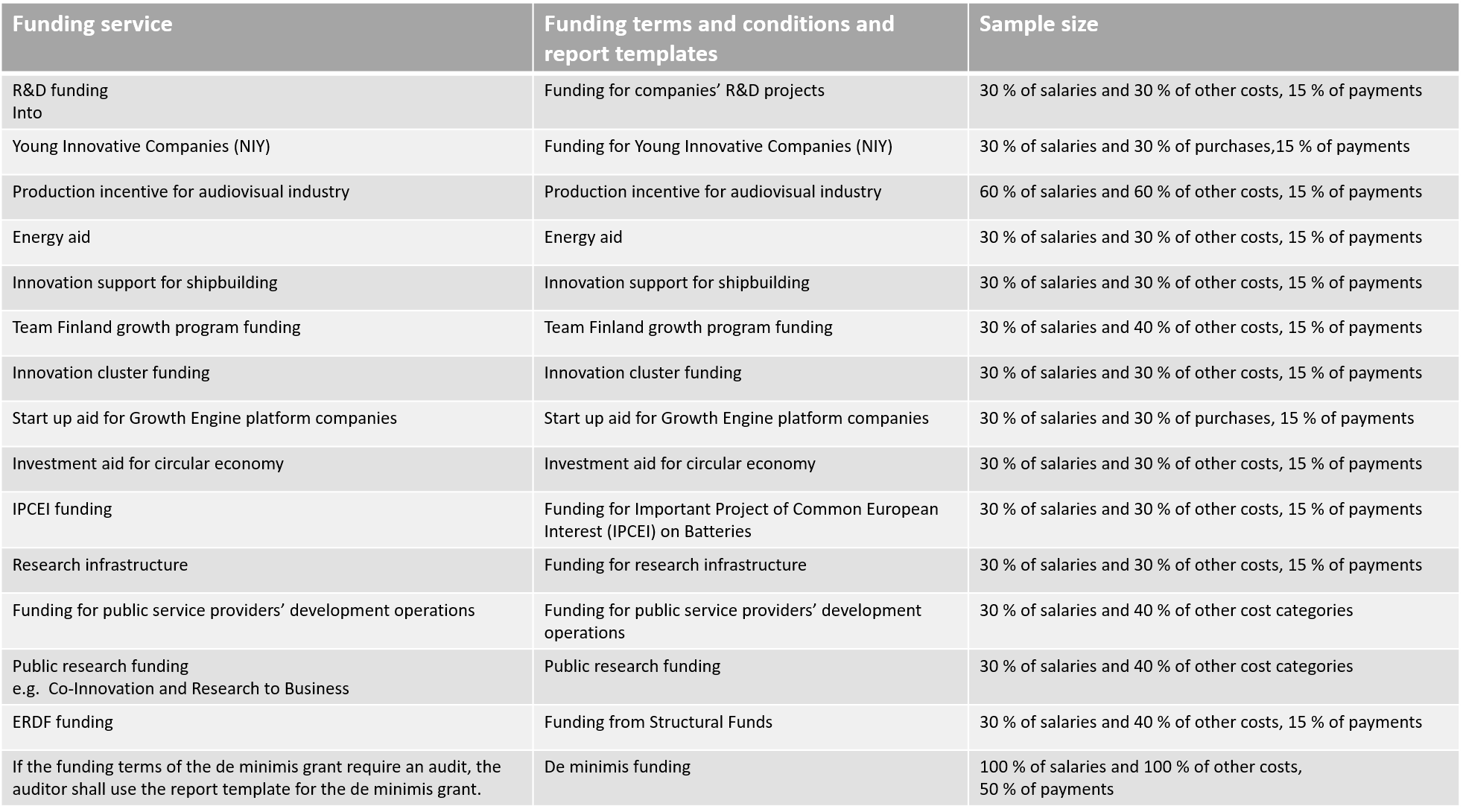

Different sample sizes are used in the audits, depending on the funding service. If there are several observations, we may also ask that the auditor perform the audit with a larger sampling.

Sample sizes for funding services

Sample sizes for funding services

The sampling includes costs from all declared cost categories. In order to verify that costs fall within the project period, it is recommended that the sampling include costs particularly from the start and end of the project. The project period refers to the duration of the project stated in the funding decision or project change decision issued by Business Finland.

Costs accrued before the start of the project period are not eligible costs, regardless of their time of payment. If an order has been placed before the start of the project, the order must include a cancellation clause. This means that the order contract must provide that the buyer has the right to cancel the order should the project not be implemented.

Costs accrued after the end of the project are not considered eligible costs. However, an invoice may be dated after the end of the project period, as long as the cost has been accrued during the project. The sole exception to this are costs incurred by the auditor’s report, which may be accrued after the end of the project period.

The invoice for the auditor’s report itself need not be included in the audited costs, but can be approved as a separate expenditure for the project. Be sure to deliver the invoice for the project audit to the client without delay to ensure that it is included in the project costs.

Project accounting

In project accounting, costs incurred during the project must be itemized, and their connection to the accounts and the cost statement be clearly visible. The project number or cost center may be used to itemize costs.

The individual working time monitoring of project employees is also a part of project accounting.

Working time monitoring

As a rule, the funding terms and conditions require that projects carry out working time monitoring of hours worked on the project. Working time must be monitored even in cases where an individual is hired solely to work on the project. If working time monitoring has not been arranged in accordance with the funding terms and conditions, the salaries of the individual in question may be ruled out of eligible project costs.

For projects for which the funding decision has been made before 1 January 2024, we require monitoring of total working hours in addition to the project hours, if no working hours are specified in the employment contract or if the person is not bound by the Working Hours Act. For projects funded after 1.1.2024, the total working time is calculated on a pro-rata basis (10h/day). Be sure to always check the funding terms and conditions on the obligation on working time monitoring.

The individual’s supervisor or the accountable project leader must confirm hours worked on the project in a way that can be verified in the monitoring system. The auditor must comment on this procedure in the auditor’s report.

By answering all questions in the auditor’s report template, Business Finland will receive the information needed to process the cost statement and pay the funding.

Salaries

The approval of salaries is based on working time monitoring and paid salaries subject to withholding tax.

The beneficiary may only declare the proportion of a person’s salary that corresponds to the total working hours allocated to the project and is based on the monitoring of effective working time. In cases where an individual is employed solely for work on the project, the declared salary must exclude costs such as paid public holidays, sick pay and holiday pay and bonus, as these do not constitute effective working time.

Business Finland may also moderate salaries approved for the projects by approving the salary of an individual in reduced sum. If a salary has been approved in reduced sum, this is stated separately in the special terms and conditions to the funding decision.

If an individual is paid a work compensation in lieu of a salary, this should be declared under purchased services.

Procurements

If the beneficiary is a public procurement unit or a company that has received funding from Business Finland or other public funding that covers more than 50% of the contract, the beneficiary must comply with the Act on Public Contracts. The procurement must be subject to tendering as a public contract when its total value, exclusive of VAT, exceeds the national threshold value set in the law.

If said procurement unit has made a procurement in violation of the procurement provisions, the procurement price is not an eligible cost. If the funding received by a company exceeds 50% and the Act on Public Contracts has not been complied with, the share of funding may be at most 50%.

Grants issued by Business Finland are considered public funding in full. In the case of loans, only the interest subsidy stated in the funding decision is considered to be public funding. Subordinated loans are considered as equivalent to grants.

Purchased services

The auditor’s report templates specify the sampling sizes to be used in audits. For example, in the case of de minimis funding, 100% of purchased services must be audited and ensured that they do not include purchases other than expert services. If the purchased services include such ineligible purchases, state their costs in the report to allow Business Finland to deduct them from the funding.

Purchased services from group companies or other associated companies

The definition of an associated company is specified in the funding terms and conditions. The terms and conditions of different funding services differ in their stance toward purchases from associated companies to some degree. Go over the funding terms and conditions with the client and take any steps necessary toward ensuring compliance already in advance.

Business Finland reviews services purchased from associated companies more closely than other outsourced services. In de minimis funding, purchased services from associated companies other than companies within the same group are prohibited. In some funding services, such as R&D funding, a separate cost statement is required from the associated company, and the purchased services are accepted without margin. If such purchased services are found, list them in the report to ensure that Business Finland receives the information needed for their possible review.

The associated company's cost statement is made on the forms according to the instructions on the Reporting page. The audit report template is the same as the one used for the audit of the beneficiary's project. If there is more than one group or associated company, each company submits its own cost statement with audit reports. Each company's statement is packaged in a single pdf file.

Follow-up audits

In addition to regular monitoring activities during the project period, Business Finland conducts follow-up audits for some 60-70 projects each year. The purpose of the follow-up audit is to verify that the work for which costs have been declared to Business Finland during the project period has been carried out, and that the work has complied with the funding terms and conditions. The follow-up audit is carried out by a Business Finland expert familiar with the client’s industry and an authorized auditor.

The projects subjected to a follow-up audit are selected randomly. The majority of follow-up audits are carried out for projects that have ended and for which an auditor's report has been submitted to Business Finland. However, Business Finland will also carry out follow-up audits for projects suspended due to the liquidation or bankruptcy of the company. A large portion of the follow-up audits discover actions that are in violation of the funding terms and conditions. Significant violations lead to the partial or full claw-back of funding.